SpaceX needs to beam cheap broadband internet everywhere throughout the planet. It’s going to step toward making that a reality.

Elon Musk’s rocket company will endeavor to convey a batch of 60 satellites into low-Earth orbit, the first for a megaconstellation of satellites that SpaceX is calling Starlink. Liftoff is planned for Thursday evening from Cape Canaveral, Florida.

It was planned to take off Wednesday night, however harsh breezes in the upper atmosphere caused a one-day delay, as per the SpaceX webcast host.

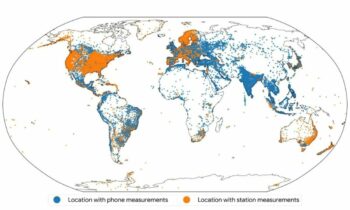

The launch is a small part of what SpaceX at last needs to be an a lot more fantastic project: a gathering of conceivably a great many satellites twirling over Earth that the company says could in the end make accessiblelow-cost internet for a significant portion of the world’s population that isn’t yet online.

In the event that SpaceX is successful Thursday, the launch would stamp the biggest test yet for any company endeavoring such a venture. It could even set SpaceX up to prevail over contenders like Amazon and SoftBank-supported OneWeb, which each need to shape web star groupings of their own.

The undertaking is still in its initial days. Musk told correspondents amid a phone call Wednesday that the satellites in the main group will be for all intents and purposes indistinguishable to the large scale manufacturing form. The main component they need is the capacity to speak with one another while in orbit.

“There is a lot of new technology here, so it’s possible that some of these satellites may not work,” Musk said, adding that there is a “small possibility” that none will work.

SpaceX will require another six missions, he said, before Starlink can provide consistent internet coverage for small parts of the world. It will take 12 launches before the company can provide coverage for a significant portion of the world’s population, according to Musk.

Getting the full star grouping fully operational will probably cost billions of dollars, and Musk has surrendered that such endeavors have bankrupted others, similar to the satellite administrator Iridium. Be that as it may, when gotten some information about SpaceX’s funading, he said the company has “sufficient capital” to carry out its plans. He added that SpaceX’s latest funding round attracted “more interest than we were seeking.” In April, the company sought to raise about $400 million.

At the present time, internet is generally conveyed by means of remote cell towers or cables steered to your home or office. That leaves very rustic or devastated communities without moderate access. There are possibilities for satellite-based internet, yet those services are famously slow, expensive or unreliable. (The Wi-Fi you get on board a transatlantic flight, for example, is delivered from satellites.)

The most concerning issues with satellite-based web access right presently are that it’s unreasonably expensive for regular customers, and the satellites are so distant from Earth that they have baffling dial-up era lag times.

SpaceX is one of a few companies that needs to update internet delivery. The thought is to set up modest satellites that stay in circle a lot nearer to home. In low-Earth circle, however, satellites burst over the sky incredibly rapidly — which is the reason a huge “megaconstellation” is required, so as to blanket the lower altitude and avoid service interruptions.

SpaceX has rivalry from other vigorously supported companies. OneWeb and Amazon are the enormous ones, yet there are additionally lesser known companies, as LeoSat and Telesat.

Amazon disclosed its Kuiper Project plans a month ago. What’s more, rival OneWeb, which has pulled in billions in venture from companies including SoftBank and Qualcomm, as of now has the initial six satellites of its group of stars up.

A successful launch Thursday would “surely put SpaceX in the lead,” said Shagun Sachdeva, an analyst at Northern Sky Research.

Yet, Sachdeva has brought up issues about whether SpaceX is shrewd to design a heavenly body of satellites that could eventually total 12,000.

She expects the company will reach a tipping point at which deploying new satellites will no longer be worth it. For example, the company won’t get much benefit out of providing full coverage over the oceans.

“It is crucial to recognize the point where” the costs start to outweigh the benefits, she wrote in a recent report.