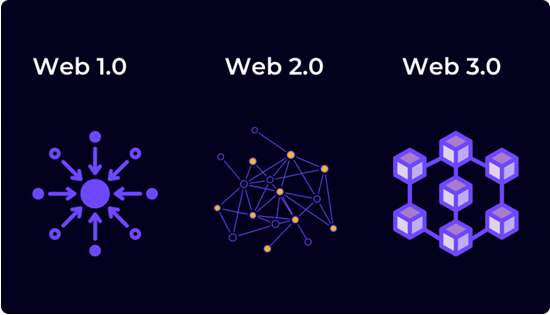

At its core, Web 3.0 relies on blockchain platforms, cryptocurrencies and unforgeable tokens to restore ownership to people. Some reports suggest that Web1 involved read-only, Web2 was read-write, and now Web3 is also about read-write and ownership.

DFEX is a peer-to-peer trading marketplace where users can trade and manage crypto directly, bypassing intermediaries. DFEX can replace traditional intermediaries such as banks, brokerages, and payment systems, using blockchain smart contracts to trade assets.

Traditional financial transaction processes often lack transparency and rely on intermediaries to execute them, and many of the intermediary’s operations are not publicly available. In contrast, DFEX is completely open about the flow of funds and the mechanics of the transaction. In addition, because user funds in transactions do not pass through third-party crypto wallets, DFEX reduces counterparty risk in the crypto ecosystem as well as systemic centralization risk.

DFEX is the cornerstone of decentralized finance (hereinafter referred to as DeFi) and an essential piece of “cryptocurrency Lego” that can be combined without licensing and can create more advanced financial products.

DFEX has a number of different design models, each with its own advantages and disadvantages in terms of functionality, scalability and decentralization. The two most common types include order book DFEX and automated market maker (AMM). DFEX aggregators are also common models, and these can search for the best deal price or lowest gas fee among the various on-chain DFEXs to best meet the trading needs of users.

The biggest advantage of DFEX is the use of blockchain technology and tamper-evident smart contracts to guarantee a very high level of certainty. centralized trading platforms such as Coinbase or Coinan (hereafter referred to as CEX) use internal aggregation transaction engines to carry out transactions, while DFEX executes transactions through smart contracts and blockchain. In addition, DFEX users are able to manage their account funds completely autonomously through their own wallets during trading.

DFEX users generally have to pay two types of fees, one is network fee and the other is transaction fee. The network fee refers to the gas fee for on-chain transactions, while the transaction fee is paid to the underlying protocol, the liquidity provider of the protocol, the pass holder or all of the above entities according to the protocol.

The ultimate vision of DFEX is to create a pure on-chain infrastructure that requires no licensing, eliminates any centralized single point of failure risk, and decentralizes ownership to distributed members of the community. This is most typically done by granting administrative rights to govern the protocol to a decentralized autonomous organization (hereafter DAO), formed by the relevant community whose members make key decisions for the protocol by voting.

However, it is no easy task to decentralize a protocol to the greatest extent possible while allowing it to kill the competition in a highly competitive marketplace. the core development team of a DFEX is usually better equipped to make comprehensive and rational judgments about the key functions of the protocol than the members of the decentralized community. But even so, many DFEXs have opted for a distributed governance model with the hope of improving manipulation resistance and long-term robustness.